Lets Try Again

S&P 500 had a wild swings day, and didn't rising assuredly – credit markets didn't motion correspondingly either. The upswing looks postponed unless fresh signs of broad weakness go far. Yesterday'south session didn't tell much either way – the inaugural to the upswing materializing, is on even though tech didn't take reward of college bond prices. That can nevertheless come.

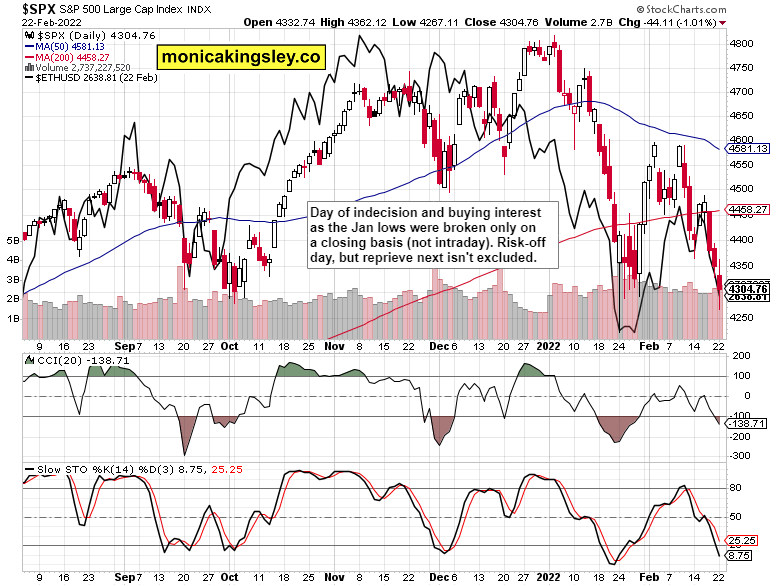

VIX though reversed to the downside, and the relatively calmer session we're likely going to feel today, would be consistent with a small-scale try for stocks to motility higher. I'm though not looking for a monstrous rally, fifty-fifty though we're trading closer to the lower end of the broad S&P 500 range for this year than to its upper edge. The 4,280s are so far holding merely as the Mar FOMC approaches, nosotros're likely to see a fresh turn south in the 500- strong index. For now, the talk of raising rates is on the back burner – Europe is in the spotlight.

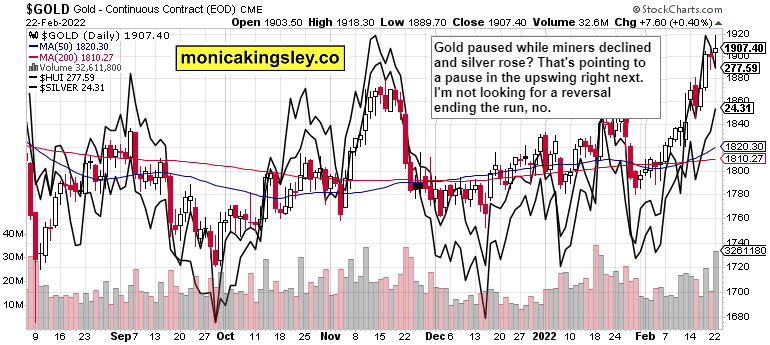

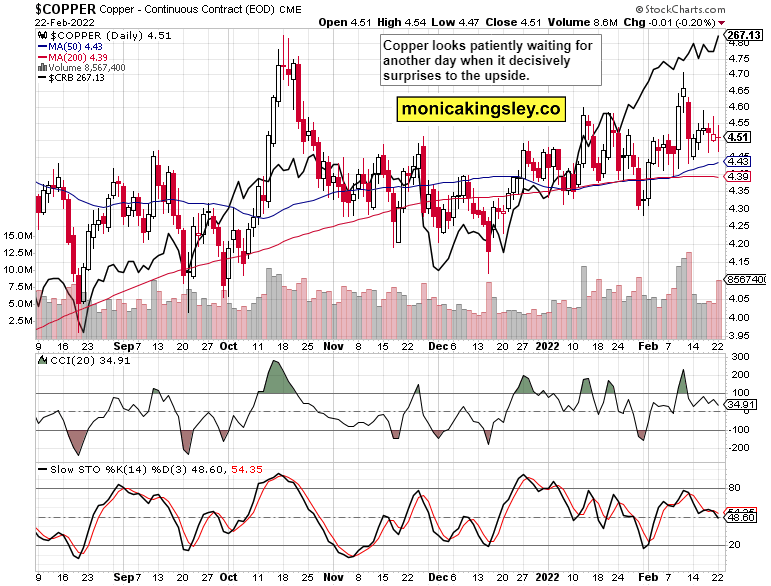

Annotation that the flying to condom on rising tensions (Treasuries, gold and oil up) didn't benefit the dollar. Coupled with the yields reprieve, that makes for farther precious metals gains – the balderdash run won't be toppled if soothing news arrives. Likewise rough oil isn't going to tank below $xc, and remain at that place. Bolt can be counted on to keep running – led by energy and agrifoods, with base of operations metals (offering a helping hand to silver) in tow. As I wrote weeks ago, this is where the real gains are to be found.

Let's move right into the charts.

South&P 500 and Nasdaq outlook

S&P 500 volume moved a little up, meaning the ownership involvement is nonetheless there – convincing signs of a trend change are though nonetheless not credible. Should prices prove to have trouble breaking lower over the adjacent 1-ii days, this could still turn out a good identify for a piddling long positon.

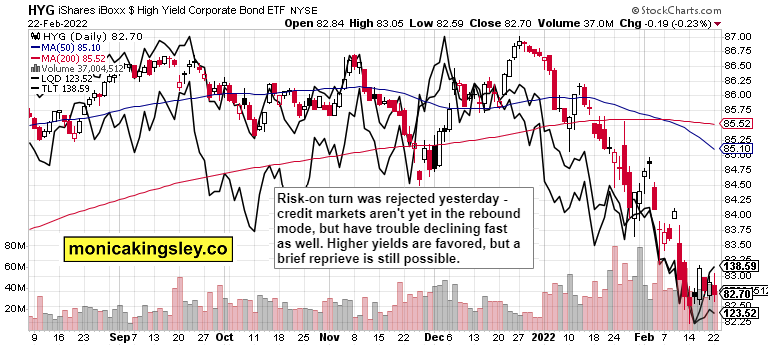

Credit markets

HYG continues basing, and keeps trading in a take a chance-off manner, which is why I can't be wildly bullish stocks for now. Stock market gains are likely to remain subdued, noticeably subdued – every bit a bare minimum for today.

Gold, silvery and miners

Precious metals fireworks continue, merely a little reprieve is developing – nix though that would break the bull. The run is but starting, and would continue through the rate raising cycle.

Crude oil

Crude oil is adequately well bid, and doesn't appear to be really dipping any time before long. Oil stocks are preparing for an upswing, and would remain one of the best performing Southward&P 500 sectors. Tripple digit oil is a question of time.

Copper

Copper'southward moment in the spotlight is approaching as commodities keeps pushing higher, and base of operations metals are breaking up. All of these factors are inflationary.

Bitcoin and Ethereum

Cryptos are attempting to move up today, and farther gains are likely. I'm though looking for the 50-solar day moving boilerplate in Bitcoin (corresponding roughly to the mid Feb lows in Ethereum) to evidence an obstacle.

Summary

Due south&P 500 didn't intermission to new lows overnight, and appears to exist picking up somewhat today. The predictable rebound might materialize afterward today, and would require bail participation to be credible. I'thou not looking for sharp gains inside this upswing though – the correction looks very much to have further to run. It'south commodities and precious metals where the largest gains are to be made, with the European tensions taking the focus off inflation (momentarily). The pressure level on the Fed to human activity decisively, is though notwithstanding on as various credit spreads tell – and the same goes for the compressed yield bend speaking volumes about the (precarious) land of the real economy.

All essays, enquiry and data represent analyses and opinions of Monica Kingsley that are based on bachelor and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without find. Monica Kingsley does non guarantee the accurateness or thoroughness of the data or information reported. Her content serves educational purposes and should non be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she volition not be held responsible or liable for whatever decisions y'all make. Investing, trading and speculating in financial markets may involve loftier gamble of loss. Monica Kingsley may have a curt or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Source: https://www.fxstreet.com/analysis/lets-try-again-202202231511

0 Response to "Lets Try Again"

Postar um comentário